Correct Appraisal Errors Up to Five Years Back — Permanently

For owners of high-value commercial properties, even a small valuation error can lead to significant and repeated tax losses year after year.

Under Section 25.25 of the Texas Tax Code, property owners have the opportunity to correct those appraisal mistakes for up to five prior years—unlocking refunds, restoring accuracy to property records, and preventing future overvaluations.

By leveraging this provision strategically, Republic Property Tax helps you recover substantial overpayments, strengthen portfolio performance, and achieve lasting accuracy in their taxable valuations.

That means greater financial control, predictable expenses, and long-term protection for your investment assets.

What is a Correction Motion?

A Correction Motion is a powerful legal and valuation mechanism that allows a property owner to amend factual or clerical errors on the appraisal roll.

Unlike a standard protest, it can be filed anytime during the year and reach back as far as five years, offering a way to reclaim value from previously closed tax years.

In essence: it corrects the record — not just the bill — creating a permanent fix that strengthens both immediate and future tax positions.

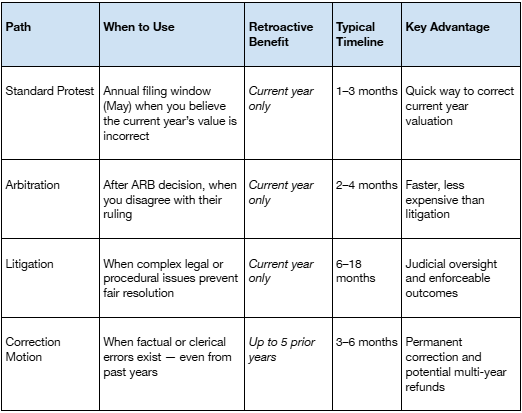

How Correction Motions Compare to Other Remedies

Here’s how this process stacks up against other property tax appeal options — and why it’s often the most financially rewarding for high-value properties.

Based on the information above, if your case fits the requirements for a correction motion, fill out the form below, and we’ll schedule time to review the specifics of your case.

If your situation doesn’t seem to fit the criteria for a correction motion, you will want to consider arbitration or litigation services.

When it Applies

Correction Motions are most effective for owners of commercial, industrial, multifamily, and high-value residential properties when errors or discrepancies significantly distort taxable value.

You may qualify if your property record shows:

- Overvaluation of 30% or more relative to market data

- Factual or clerical errors such as mis-stated square footage, incorrect land use, or missing depreciation

- Omitted or incorrect exemptions (e.g., productivity or partial-use exemptions)

- Inaccurate condition or classification data carried over multiple years

- Repeated assessment errors that compound across a portfolio

For portfolio owners and investors, identifying these issues can free hundreds of thousands in tied-up capital.

If your concern is about appealing the value of your property—such as disputing the appraisal amount or believing your property is overvalued by less than 30%—then you may need to pursue arbitration or litigation instead.

Not sure?

>> Our team can help you determine if a correction motion is right for your case.

Why Correction Motions Matter

A successful correction motion doesn’t just generate a refund — it permanently adjusts the underlying valuation data that drives future tax liability.

The benefits include:

- Retroactive refunds for up to five years of overpayments

- Permanent correction of property records to prevent repeat overvaluations

- Portfolio-wide consistency across multiple parcels and jurisdictions

- Enhanced financial performance through reduced tax exposure and improved NOI

In short, correction motions deliver both immediate cash recovery and long-term accuracy.

>> Fill out this form to get started.

How Republic Property Tax Can Help

Republic Property Tax specializes in navigating high-value correction motion cases that require both legal insight and valuation depth. Our process combines advanced data analysis with in-house legal filing, ensuring every case is positioned for maximum recovery and compliance.

How you benefit with Republic Property Tax:

- Integrated legal and valuation expertise under one roof for precision filings

- Data-driven review to uncover hidden or multi-year errors in appraisal records

- Efficient communication with appraisal districts and ARBs to accelerate outcomes

- Proven track record in recovering substantial refunds for complex commercial portfolios

We focus on select, high-impact cases where a single correction can produce significant and lasting financial benefit.

If you own or manage commercial or high-value properties and suspect overvaluation or misclassification, a Correction Motion under Section 25.25 may be your most powerful option for recovery.

Schedule a consultation using the form below.

Get Started Today

We’ll evaluate your property records, determine eligibility, and build a case for both retroactive refunds and long-term accuracy.